The Client

Client: Parker Lewis

Age: 27

Occupation: Engineer

Primary Goal: Build an emergency fund, pay off student loans, and start saving for retirement

The Situation

Parker recently landed his first professional role as an engineer at a major company in Texas. He’s excited about this new chapter in his life and eager to make the most of his growing income and excellent employer benefits. However, Parker feels stuck when it comes to managing his finances. He has $35,000 in student loans, a rent payment that takes up a significant portion of his budget, and no emergency fund to fall back on if unexpected expenses arise.

While Parker’s employer offers a 401(k) with a generous 4% match, he’s unsure how to balance loan payments, emergency savings, and retirement contributions. Additionally, Parker opened a Roth IRA but hasn’t made significant contributions yet, as he’s been focused on debt repayment. He’s heard about investing in index funds but doesn’t know how to diversify or balance risk and reward. Parker also dreams of advancing his career by earning additional certifications, but he’s not sure how to save for them without derailing his other financial goals. Feeling overwhelmed, he reached out for help to build a plan that fits his needs and sets him up for long-term success.

The Approach

To help Parker gain clarity and confidence, we developed a comprehensive plan that addressed his immediate needs, long-term goals, and investment education. Here’s how we approached his financial strategy:

- Budget Development:

We created a realistic budget that allocated funds to Parker’s most pressing needs—building an emergency fund, managing his student loan payments, and beginning retirement contributions. By identifying areas where he could reduce discretionary spending, we freed up additional cash flow to meet his goals. - Debt Repayment Strategy:

Parker’s student loans were a significant source of stress. We evaluated his loan terms and designed a repayment plan that focused on paying off high-interest debt while maintaining flexibility for other financial priorities. - Savings Automation:

To ensure progress without additional effort, we automated contributions to Parker’s emergency fund and retirement accounts, helping him stay consistent in building financial stability. - Career Fund Allocation:

We set aside a small portion of his budget for a “career growth fund” to help him save for certifications that could increase his earning potential without adding financial strain. - Investment Planning:

We worked with Parker to create a custom investment portfolio tailored to his risk tolerance, timeline, and goals. This included aligning his 401(k) and Roth IRA contributions with a strategy designed for long-term growth and diversification.

The Results

Parker came away from the engagement with a clear, actionable financial plan and the tools he needed to move forward confidently:

- Emergency Fund: With automated savings in place, Parker is on track to build a three-month emergency fund within a year, providing him with a safety net for unexpected expenses.

- Student Loan Reduction: His targeted repayment strategy ensures that he’s reducing his debt faster while saving thousands in interest over time.

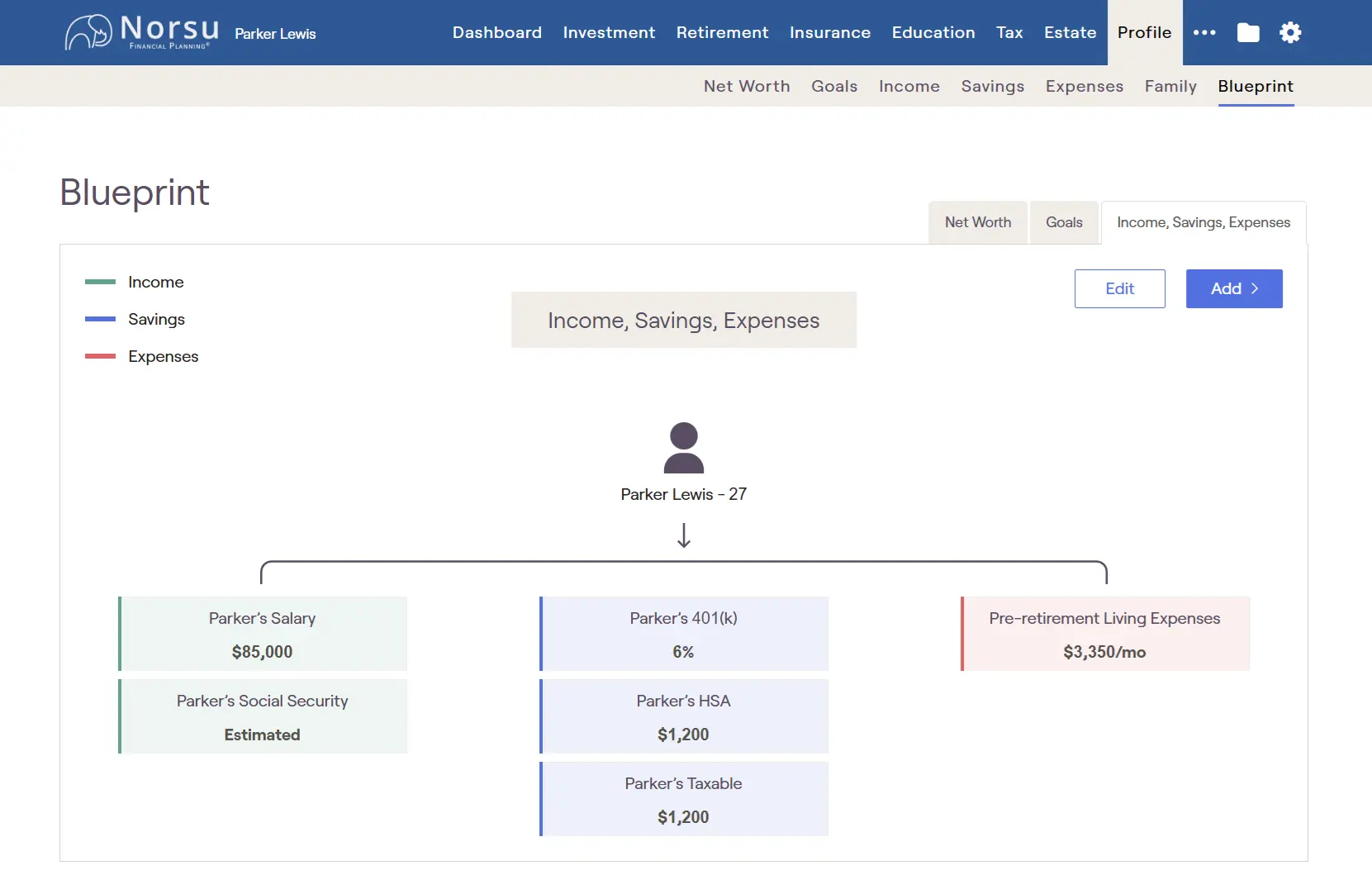

- Retirement Savings: Parker is now contributing 6% of his salary to his 401(k), maximizing his employer match and building a strong foundation for the future.

- Investment Strategy: His 401(k) and Roth IRA contributions are now aligned with a diversified portfolio tailored to his goals and risk tolerance.

- Career Growth: His “career growth fund” is building steadily, giving him the financial freedom to pursue certifications that will support his professional ambitions.

- Peace of Mind: Parker feels more confident and less stressed about his financial future. With his investments aligned and automated systems in place, he knows his money is working hard for him.

By incorporating investment planning, savings automation, and a clear debt repayment plan, Parker has a roadmap to achieve both his immediate needs and his long-term financial goals. Regular check-ins ensure his plan evolves as his life and career progress.

DISCLAIMER: To protect client privacy, these case studies are hypothetical examples that illustrate the types of financial planning strategies we may recommend. Every financial situation is unique, and no guarantees can be made regarding future outcomes. Please consult a licensed financial professional (like Norsu) for advice tailored to your individual needs.

See More Case Studies

Let's Get Started

Take the first step in getting set up for your best financial future! Schedule a free call using the link below and we’ll discuss your goals and a plan to get you there.